In a world where resources and investments play an important role in both personal and business success, the art of effective asset management emerges as a cornerstone. Whether you’re an individual looking to optimize your financial portfolio or a business aiming to streamline operations, understanding asset management is essential. This comprehensive guide aims to unravel the complexities of asset management by addressing some of the most frequently asked questions (FAQs) on the topic. From the basics to the intricacies, we’re here to provide you with clear and concise insights, helping you navigate the realm of asset management with confidence.

In a world where resources and investments play an important role in both personal and business success, the art of effective asset management emerges as a cornerstone. Whether you’re an individual looking to optimize your financial portfolio or a business aiming to streamline operations, understanding asset management is essential. This comprehensive guide aims to unravel the complexities of asset management by addressing some of the most frequently asked questions (FAQs) on the topic. From the basics to the intricacies, we’re here to provide you with clear and concise insights, helping you navigate the realm of asset management with confidence.

What is asset management?

Asset management refers to the systematic process of managing a person’s or organization’s assets for optimal utilization, maintenance, and growth. It involves meticulous tracking, evaluating, and making informed decisions about various assets, such as financial investments, physical property, intellectual property, and more. By understanding the nuances of asset management, individuals and businesses can enhance their ability to navigate dynamic markets and achieve their financial objectives.

How do financial assets and physical assets synergize within asset management?

Financial assets and physical assets synergize within asset management through their combined contribution to an organization’s value and growth. Financial assets, such as stocks, bonds, and equities, provide liquidity and avenues for capital appreciation. On the other hand, physical assets, including real estate, machinery, and infrastructure, offer tangible value, operational support, and potential long-term appreciation. This synergy enables diversification, risk mitigation, and optimization of returns in an organization’s asset portfolio.

How can the synergy between financial and physical assets benefit asset management strategies?

The synergy between financial and physical assets bolsters asset management strategies by diversifying risk exposure. In times of market volatility, physical assets can provide stability as they are less prone to abrupt value fluctuations compared to financial instruments. Conversely, financial assets offer liquidity and flexibility, allowing organizations to capitalize on market opportunities. The combination helps balance short-term gains with long-term stability, creating a resilient portfolio that aligns with the organization’s financial goals.

Why is asset management important?

Maintaining physical assets is crucial within effective asset management due to its role in preserving value, minimizing disruptions, ensuring safety, and enhancing operational efficiency. This proactive upkeep helps extend asset lifespan, prevent unexpected breakdowns, adhere to safety standards, control costs, and optimize resource allocation. As a result, businesses can maximize returns on investments, reduce risks, and align their asset strategies with broader organizational goals

What are the key benefits of asset management?

Asset management offers several benefits, including improved decision-making, reduced downtime, enhanced cost control, increased asset lifespan, regulatory compliance, and optimized resource allocation.

What are the main types of asset management?

There are various types of asset management, including financial asset management (managing investments), physical asset management (managing tangible items like equipment), infrastructure asset management (managing public infrastructure), and IT asset management (managing software and hardware assets).

How does asset management work?

Asset management encompasses a range of critical steps, including asset identification, tracking, assessment, maintenance, risk analysis, performance evaluation, and strategic planning. To facilitate these processes and enable informed decision-making, organizations often utilize Computerized Maintenance Management Systems (CMMS) and other specialized software. CMMS helps streamline maintenance scheduling, tracks asset condition, and supports data-driven insights, ultimately contributing to efficient asset utilization, extended lifespan, reduced downtime, and enhanced overall operational efficiency. This integration of technology within asset management underscores the importance of maintaining physical assets to achieve optimal outcomes and align with overarching objectives.

What role does technology play in asset management?

Technology, including asset tracking software, data analytics tools, Internet of Things (IoT) devices, and Computerized Maintenance Management Systems (CMMS), plays an important role in asset management. These technological advancements empower organizations with real-time monitoring capabilities, data-driven insights, predictive maintenance strategies, and optimized resource allocation. CMMS, for instance, streamlines maintenance schedules, monitors asset conditions, and aids in strategic decision-making, ensuring that physical assets are well-maintained, aligned with goals, and capable of delivering peak performance over their lifespan.

How can businesses implement effective asset management strategies?

To implement effective asset management, businesses should establish clear goals, prioritize assets, create maintenance schedules, use asset management software, conduct regular audits, train staff, and stay updated on industry best practices.

What are the challenges associated with asset management?

Challenges include data accuracy, scalability, changing regulations, technological complexity, and ensuring that assets are aligned with business objectives. Overcoming these challenges requires careful planning and continuous adaptation.

What do asset managers do?

Asset managers hold a key responsibility in managing both financial and physical assets within a company’s portfolio. These assets range from real estate and commodities to monetary instruments like stocks, shares, and bonds. Your central objective as an asset manager is to strategically boost investment returns. This entails not only navigating the complexities of financial markets but also ensuring the effective upkeep and optimization of physical assets, contributing to the overall growth and success of your organization.

How does the interaction between financial assets and physical assets impact decision-making for asset managers?

The interaction between financial and physical assets influences asset managers’ decision-making by prompting a holistic approach. Asset managers must consider not only market trends but also the operational impact of physical assets. For instance, when reallocating resources, they must balance selling financial assets for liquidity with retaining physical assets for continued productivity. This interplay requires asset managers to strike a delicate equilibrium that optimizes returns while ensuring the organization’s operational effectiveness.

Can you provide an example of how the synergy of financial and physical assets creates value for asset management?

Consider a manufacturing company with a diverse asset portfolio. By investing in financial assets like bonds and stocks, they generate potential returns while maintaining liquidity for operational needs. Simultaneously, owning physical assets like advanced machinery ensures efficient production processes. If market downturns affect financial assets, the company’s physical assets remain operational, preventing severe disruptions. This integrated strategy mitigates risks and positions the company for sustained growth, showcasing the value of synergy between financial and physical assets.

Final Thoughts

Asset management stands as a pivotal pillar in the foundation of any successful company. Its significance lies in the strategic orchestration of an organization’s resources, encompassing both financial and physical assets. Through meticulous planning, tracking, maintenance, and optimization, asset management ensures that investments are maximized, risks are mitigated, and overall objectives are achieved. Whether it’s the efficient utilization of machinery, the shrewd management of financial instruments, or the careful consideration of real estate, asset management empowers companies to navigate the complexities of their operational landscapes with foresight and precision. By harmonizing the synergy between financial and physical assets, companies can drive growth, resilience, and long-term sustainability, showcasing how effective asset management is a cornerstone of strategic success in today’s dynamic business environment.

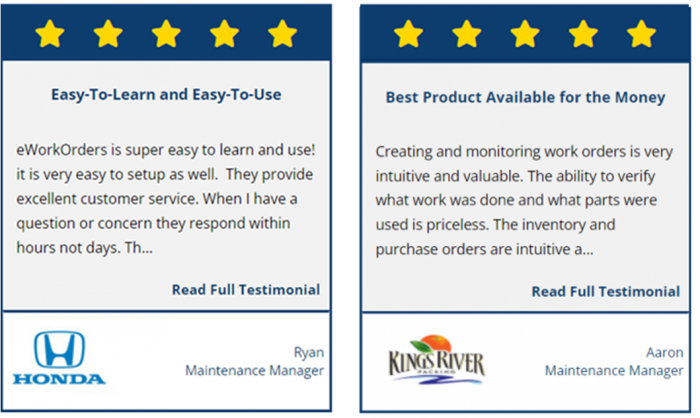

Discover Success Secrets: Journey Further with eWorkOrders

Other Resources

Asset Management Terms and Definitions Glossary

Securing Your Assets: How Asset Tracking Software Helps Avoid Disasters

The Power of Reliability: Key Types for Maximizing Asset Performance

Geographic Information System (GIS) Terms & Definitions Glossary

Maintenance Terms and Definitions Glossary

Additional articles, checklists, and directories